The Dealer Huddle West & East events are now completed, and we’re excited to finally share a more in-depth look into the topics discussed.

Each event had a slightly different speaker lineup, but overall, the big topics revolved around managing your circle of control in times of uncertainty, shining a bigger light on fixed ops, what to do with used car acquisitions, and paying attention to different media streams to stand out in a saturated market.

Our very own Head of Customer Success, Rhys Albrecht, was on the big stage in both Calgary and Toronto and had the opportunity to speak on two very different topics. In Calgary, the focus was on attention: getting it, deserving it, and keeping it, and how different forms of attention can impact your advertising. For example, involuntary attention is like a Google Display ad, you might be surfing weather.com to see this weekend’s forecast and you notice an ad for Kia’s new EV4 on the right hand side, while voluntary attention would be more like the vehicle ads you get served when putting a direct search into Google.

In Toronto, the conversation was very different, and Rhys got the opportunity to host a standout panel featuring: Gerald Wood (MDA), Holly Clarke (Meta), and Daniel Ross (Canadian Black Book) for a candid conversation about the current and future landscape of Canadian automotive. They tackled the thorny but essential issues facing automotive today, from political headwinds to evolving consumer behavior and long-term product strategy.

This wasn’t a traditional keynote, it was an unfiltered, no-holds-barred discussion tackling the real issues: rising market pressures, rapid tech disruption, shifting consumer expectations, and what it all means for dealers moving forward.

Special thanks to Bri Newman, Blair Allison, Mathew Growden, Blake Bradley, Bill Warren, and Jay Radke for sharing VIP access codes with their networks and helping more attendees get through the door, and also opening up the additional seats, as this was a chat not to be missed!

Insights from the Frontlines: Key Takeaways from the Panel

Political Landscape & Industry Direction

While no one claimed to have a crystal ball, the panelists painted a realistic picture of the political and regulatory backdrop. Gerald emphasized that oil will remain a central point of conversation, particularly in Canada’s ongoing trade negotiations with the U.S., and that the Zero-Emission Vehicle (ZEV) mandate will significantly impact vehicle allocation unless adjusted.

Daniel added that while the situation feels uncertain, “we’re not flying blind.” Canadian market players are leaning into data and experience, even if the road ahead isn’t clearly mapped.

Trade, Tariffs & Consumer Sentiment

Holly brought attention to the current climate of consumer hesitancy. While Q1 and April saw strong momentum, she noted that many customers are now pausing major purchases in hopes of better incentives. “Confidence is unsettled at best,” she said, “but consumers are also becoming numb to some of the noise.”

Gerald pointed out the complexity OEMs are facing: “Do they have a plan? No. They probably have 18.” His point being that in an unpredictable market, agility is more important than ever.

Post-COVID Learnings & Market Adjustments

The pandemic’s ripple effects are still unfolding. Daniel highlighted a 12% vehicle price increase in just the last 60 days, while Holly pointed out that COVID forced many dealers to level up their consumer experience strategy and also highlighted that those that did are now reaping the rewards. Gerald’s advice? “Don’t contract everything. Just be ready to pivot.”

Risk, Opportunity & The Path Ahead

The current market is polarized: Fixed Ops is strong, new vehicles are moving, but used is softening. That said, there’s still opportunity in every segment as long as you know where to look. Daniel outlined this very helpful 3, 6 and 12-month lens:

Short term: Focus on plug-in hybrids and electrified options.

Medium term: Stock up on compact cars and SUVs to attract affordability-driven buyers.

Long term: Prepare for the wave, as over 100 EV models are expected in the next decade.

Gerald also stressed the need for control and clarity: “Stick to your plan. Control what you can control.” He also championed the diversity of powertrain tech like hybrid, EV, hydrogen and even called it all “great technology.”

Old Challenges, New Focus

When it comes to training dealership staff, there are endless topics to choose from, so where should dealers focus? Holly advocated for adaptability and investing in AI tools and electrification knowledge, while Gerald pointed to a long-standing gap: “We still don’t manage our customer databases to the level that we could.”

Daniel offered a cautionary note: If new car sales stagnate again, used inventory and data mining will need to step up in a big way.

Buy Canadian Momentum

All panelists agreed that the Buy Canadian sentiment is stronger than ever. Daniel called it a “powerful trend that may be here to stay,” and Gerald urged a message shift: not just about “beating the tariffs,” but about being the better deal. Holly added that with big-box retailers pulling back spend, there’s room for dealers to lean into this movement without coming off as opportunistic.

This panel delivered exactly what Dealer Huddle Next promised: insight, honesty, and real-world perspectives that sparked meaningful conversations across the room.

Megan Coyle from The Minery, spoke on the importance of defining your circle of control in uncertain times and how there are three main pillars to focus on:

Control: the actions, decisions, and responses you have direct control over

Influence: things you cannot control but can have an influence on

Concern: things you care about but have little or no control over them

We cannot control things like tariffs and the political climate, although we can be concerned about them, so instead of placing our focus there, look to the things you can control and influence following the CIA model:

C – Is it in my control?

I – Can I influence it?

A – Can I accept it?

While inventory prices are on the rise, there is no better time than the present to have a renewed focus on fixed ops. Fenton Bolden from Axion Ops gave us the rundown on how fixed ops needs to find another gear and that dealership operators need to step up their game when it comes to recognizing them. The main message coming from Bolden was that there isn’t a skilled technician shortage problem; there’s a capacity utilization problem with most dealerships reporting a 62.5% utilization rate of their techs. The prime example he laid out was for the No Start Car.

Picture this scenario—you have a vehicle stuck outside one of your bays that won’t start, so you gather all the techs working that day to push it in. This includes senior techs who could be diagnosing the vehicles already on the lift. Think of the opportunity cost of the value of time simply from taking 15 minutes to push this vehicle in?

So, how do we solve for this? One suggestion was to bring back the Service Concierge or a Porter. Stop having your senior technicians worry about vehicles that won’t start or that need to be brought to temperature before they can get on a lift, and focus on their time utilization to get the most out of your service department.

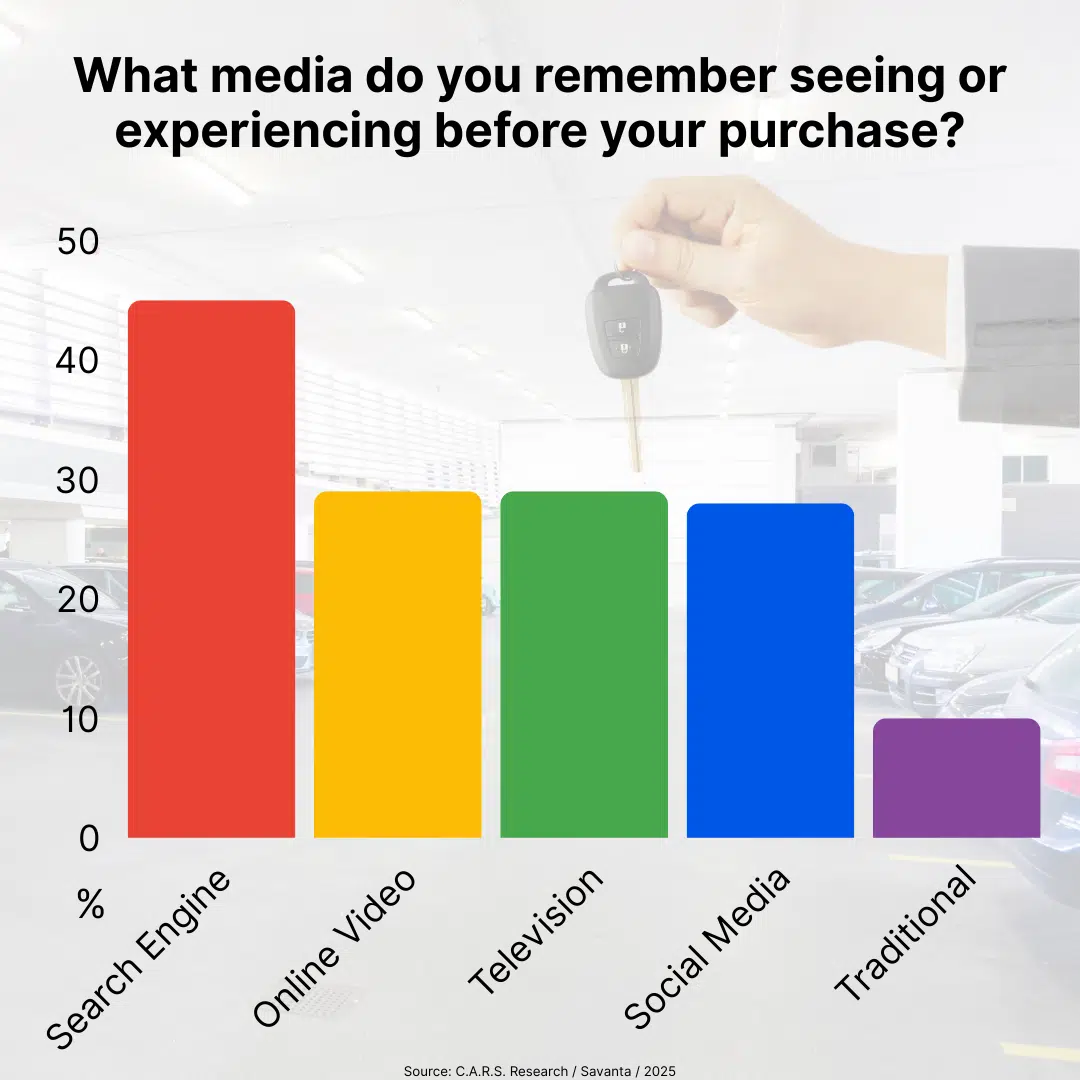

Mike Mazgay, Vice President, Automotive Partnerships & Dealer Operations at SiriusXM Canada, gave us all something to think about when it comes to thinking outside the box for your advertising strategy. With nearly 1 in 2 drivers considering their vehicle as their 3rd space (home and office being the 1st and 2nd), consumers are more dialled into their vehicles than ever. 36% of those surveyed also cited using their vehicle to take some time to get away, which increases to 63% for Millennials and 65% for Gen Z. With this much time being spent in a vehicle and with ~30 million monthly digital audio content listeners in North America, this provides a new advertising platform opportunity for dealers: podcasts. Will this be a new advertising stream to attract buyers and reach different demographics? The dealers willing to take the risk and expand their holistic advertising strategies will soon find out!

With much anticipation, Mathew Growden, ex-Google Auto & https://www.thechangeoptimist.com, hit the stage to give us the latest stats from his C.A.R.S (Consumer Automotive Research and Stuff) report. The ‘and Stuff’ portion is where he started, outlining a number of interesting EV stats that were new to us:

- 13,236 charging stations across Canada, with 34,707 charge points (700 more since the data was first presented on April 9, 2025), compared to 12,000 gas stations (but they’re in the wrong spots and keep breaking down).

- BYD is #7 globally in sales (not currently in Canada), and they have broken the 5-minute charging time from 20 – 80%.

- CATL has a 1000km battery.

- Geely has a 2400km hybrid, toting you can get from New York to Miami on one tank of gas.

From there, he dove into the deep end, giving us the much-needed stats we’ve been craving. He recently completed a survey with Savanta on “How do people buy cars?” The field survey had been completed just days before this was first presented on April 9th, and included surveying 2,000 Canadian car buyers. Here is the highlight reel of what they uncovered:

- 78% of shoppers surveyed will visit only 2 or 3 dealerships, which is up from previous survey scores from Google’s Think Auto events of yesteryear.

- 77% of buyers completed 2 or 3 test drives, with 8% noting that they didn’t visit a dealership.

- A dealership’s website still comes out on top at 29% when asked how shoppers discovered the vehicle they purchased.

- For 7/10 shoppers, they completed their buying journey within 2 months, with EV purchases taking longer and used car sales being shorter.

- Walk-ins and phone calls were the top two ways consumers would contact a dealership, at 66% and 44% respectively—moral of the story: answer your phone!

- An exceptional sales experience will outweigh the importance of location, with the latter not even ranking among the top reasons for why a dealership was selected:

- 40% vehicle price, 35% available inventory, 32% went above and beyond (new response!), 29% previous good experience, 26% quick response time

- 51% of shoppers are interested in EVs, and those who aren’t continue to have concerns with battery charge/range (55%), cost (50%), not enough chargers (46%), and charging not available at home (42%).

- 1/7 vehicles sold in 2024 were zero-emission.

- 26% said quick response time over location

So, where does this leave us? He’s going to remain bullish on EREVs and is looking forward to the continued emerging innovation from EV manufacturers globally.

Bri Newman from HR4 delivered a compelling look into the car-buying journey from the perspective of women, a group that notably, makes up the majority of car buyers in Canada. The following stats were a wake-up call: 89% of women reported that they prefer to bring something (or someone) with them when visiting a dealership, signalling a desire for added support or validation. When asked about their concerns, women were 32% more likely than men to fear feeling pressured, and 54% more likely to worry about not being taken seriously. These numbers speak volumes and make one thing clear: our industry still has work to do when it comes to creating a more welcoming, respectful, and empowering dealership experience for women.

When it comes to the car-buying journey, women bring a distinct set of priorities and preferences. Jyll Saskin Gales, Digital Strategy Expert & Inside Google Ads Founder, ex-Googler and current Google Ads coach and best selling author, highlight the significant role women play in the automotive market, both as direct buyers and as influential decision-makers:

- 40% of women are likely to consider a used or Certified Pre-Owned vehicle (compared to 30% of men)

- 55% prioritize safety features above all

- 48% are particularly concerned with vehicle size

- 74% identified price as a critical factor in their decision-making

- 64% prefer gas-powered vehicles, slightly higher than the 60% of men who said the same

- 9% of female buyers didn’t visit a dealership at all during their purchase process

The takeaway? Safety, size, and price are key drivers, and flexibility in how buyers shop—especially online—is more important than ever. Understanding these nuances helps create more personalized, relevant, and respectful experiences that actually meet women where they are.

In Calgary, the day concluded with a presentation from the event founder and owner of TierSix.io, Jay Radke. His history, near-death experiences (yes, plural), entrepreneurial spirit, and his forward-thinking nature have enabled him to live a life that most wouldn’t dare to dream. Having grown up in automotive, working through the rungs at an auction, and riding motorcycles from a young age, Radke has touched almost every aspect of the industry and explains his passion for educating dealers and bringing in the next generation.

In Toronto, we ended the day with one of the most practical and forward-thinking conversations centered on how dealers can better connect with underrepresented demographics — specifically women and new Canadians. The panel, featuring Jyll, Mathew and Benjamin L, Media Lead, Canada Marketing at Google as they delivered strong points on moving beyond check-the-box strategies and toward meaningful engagement.

It’s not about saying, “Hey women, we have this experience” as Jyll put it bluntly, instead, it’s about showing up in ways that reflect what matters most — safety messaging, thoughtful vehicle specs, and practical ownership features.

Think: “This SUV offers flexible space for life on the go” and not “We hear you like big cars, here’s a big pink car.” Representation matters: Mat emphasized hiring female sales reps to reflect the audience you’re trying to connect with on the floor — not just in your marketing.

Targeting Strategy: Reach vs. Budget

When balancing audience reach with budget constraints, Jyll suggested that dialing back targeting radius in one area may allow you to expand reach within a key demographic. Mat was even more candid: if the budget isn’t there, sometimes the campaign isn’t worth it. A good creative strategy can’t make up for a lack of scale. He referenced OEMs spending $100M on TV and then only $25K on YouTube, and the imbalance made digital underperform and “not worth it.”

Reframing the Price Conversation

Let’s face it — price is rarely just about price. Trade-ins, incentives, approval rates, and credit all impact what a buyer can actually afford. The panel emphasized shifting ad copy from the generic “We have cars for sale” to more value-anchored language like: “Cars starting from $X available now.” This gives buyers a reference point and a strong reason to explore.

Translating Video? Be Ready to Back It Up

When it comes to creating multilingual campaigns, Mat’s advice was simple: “In for a penny, in for a pound.” If you’re translating an ad into Punjabi or Mandarin, make sure someone at the store can carry on that conversation. Otherwise, you’re setting the customer and your team up for frustration. Ben added that experimentation is key: try, measure, iterate. You don’t need perfection to start, but intentionality matters.

Context, Features & Representation

These are the key takeaways:

1. Market to the person, not the persona. Highlight relevant features and benefits: whether it’s a mom balancing school pickups or a newcomer prioritizing the cost of ownership.

2. Leverage AI-powered tools (now or soon) to streamline personalization.

3. Stay authentic in visuals from who appears in your ads to who greets customers in the showroom.

4. Work with media outlets that reflect your audience, not just the broadest reach.

As Jyll put it, getting the right message to the right person at the right time is everything, and here at sMedia, we will work with you to help you do just that.

What’s Next? Let’s Keep the Conversation Going

The Dealer Huddle events served as a clear reminder that while the automotive landscape is evolving fast, the fundamentals remain: know your audience, adapt quickly, and focus relentlessly on what you can control. From electrification strategy and data-backed consumer insights to tackling bias in the showroom and exploring untapped media channels, we covered it all.

But what really stood out was this: Dealers who are willing to listen, learn, and lean in will be the ones who win even (and especially) in uncertain markets.

Whether you’re rethinking your advertising strategy, looking to better connect with underrepresented buyers, or simply want to get more out of your existing media spend, we’re here to help.

Let’s talk about what’s working, what’s not, and where your next opportunity lies.

Connect with the sMedia team now and let’s build smarter, more inclusive, and more effective campaigns together.

Want More Insights Like This?

Get our monthly newsletter packed with proven strategies, fresh trends (just the good stuff) to drive traffic, leads, and revenue right to your inbox.

👉 Sign Up Now